Group customers by their technology and service needs to become the supplier of choice.

Worldwide, the production of ready mixed concrete is fundamentally the same. A plant in Dallas operates similar to plants in Dubai, Dublin and even Tanzania’s Dar es Salaam. The needs of customers, however, can be radically different—and that’s without taking into account their unique geographies.

In any given location, consumers of ready mixed concrete can range from well-organized to chaotic, from large enterprises to small operations and from tech-savvy to technology-opposed Luddites. But why should these differences matter to producers? In short, understanding the needs of each easily identifiable group will allow you to offer the tailored services that make it easier and more beneficial for them to purchase from you versus your competition. This strategy will drive higher volumes and pricing power.

Step 1: Identify your customer segments

Let’s start by considering your largest customers. Typically, your highest-volume customers have invested in technology to increase their efficiency, such as enterprise resource planning (ERP) systems, major financial platforms and building information management (BIM) systems. They highly value the seamless electronic transfer of data between suppliers like you and their internal systems.

Now, contrast that group to your smallest, infrequent customers who may order 20 cubic yards per month at the most. They may do their accounting on napkins and write invoices by hand, which they will then stuff into envelopes and send by mail. When they want something, they make a phone call.

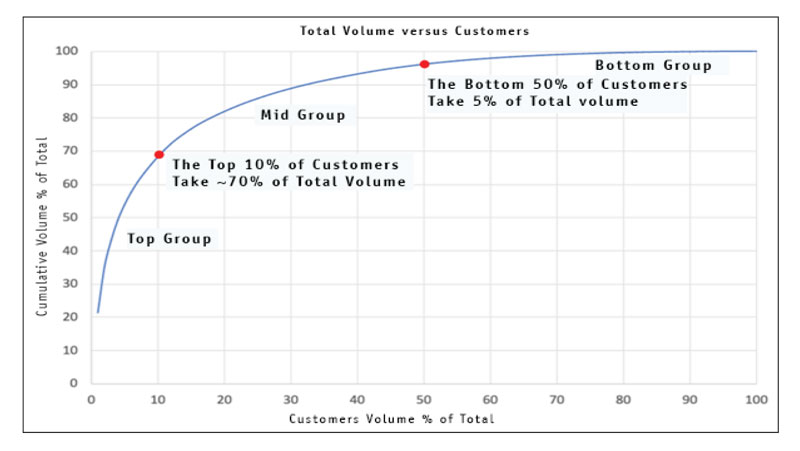

The graph below shows the typical customer distribution for the U.S., Canadian and European Union marketplace. This is ordered on the horizontal axis by customers from largest to smallest and on the vertical axis from zero to total volume shipped for the year. The curve’s general shape is universally true for ready mixed producers everywhere, with slight variations of the initial slope based on the customer mix. A higher concentration of “big” jobs will make the slope steeper, while more “cod” types of jobs will render it shallower.

Typically, the top 10 percent of your customers will consume 70 to 75 percent of the volume you produce. Inquiring minds may ask, “Why don’t we focus solely on these major customers?” The answer lies in the fact that your highest-volume customers almost always demand lower margins on material (MOM) while expecting higher levels of service. Plus, by unduly concentrating on large customers, you may put your company at risk if one or more of them falls on hard times or jumps to a competitor.

The next customer group falls between your top 10 and 50 percent of customers, consuming around 25 percent of the volume. While there are four times as many of these customers as in the top segment, they are far less sophisticated in their tech expectations, even as they embrace common digital technology like placing orders on a cell phone. They also pay much better MOM.

The final customer segment is comprised of the bottom 50 percent of your customers and typically consumes around five percent of the volume. So why bother keeping those in this group? They are almost price-insensitive and pay the highest MOM. Also, because they are more flexible in terms of service-level expectations, their orders can be worked into the delivery schedule as capacity allows.

Step 2: Customize your service levels

Each customer segmentation category—top, middle and bottom—responds to different types of service.

- The top segment prefers doing everything electronically, including quoting, ordering, fulfillment, changes and billing. They expect a smooth transfer of electronic information to their internal systems, be it ERP, BIM or financial. Your quality control (QC)-technical team often takes the place of the sales team.

- The middle segment demands up-close and personal service. While they are usually early adopters of electronic commerce, they greatly benefit from partnering with your sales team to help identify profit leaks and become more efficient.

- The smallest segment needs the most help and often avoids or misuses electronic interaction to the extent that you’ll want to limit their use. They will sidestep the sales team and need to call dispatch for everything—and you’ll need them to, as well! Although they require the highest service time per cubic yard, they pay the highest prices and almost always accept whatever trucking is available.

The key for you, as the producer, is to tailor your technological offering to each customer segment. If you position yourself as the “least hassle provider” for each identifiable group, they will stick with you like glue. The profitability paradox is that once you become known as the supplier of choice, you gain the flexibility to choose the best mix of customers and customer segments to align with your business needs.

Craig Yeack has held leadership positions with both construction materials producers and software providers. He is co-founder of BCMI Corp. (the Bulk Construction Materials Initiative), which is dedicated to reinventing the construction materials business with modern mobile and cloud-based tools. His Tech Talk column—named best column by the Construction Media Alliance in 2018—focuses on concise, actionable ideas to improve financial performance for ready-mix producers. He can be reached at [email protected].